System Requirements• Windows Vista, 7, 8, 8.1, 10 and other Windows computers or •.net framework If the.net framework is disabled on your computer or is not installed, you may see such message '.net framework version x.x is required.' You can or to solve this issue. This software can run on both 32-bit or 64-bit computer. Font for mac.

This software is compatible with Windows 10. Instructions 1. You need to login as administrator of local machine.

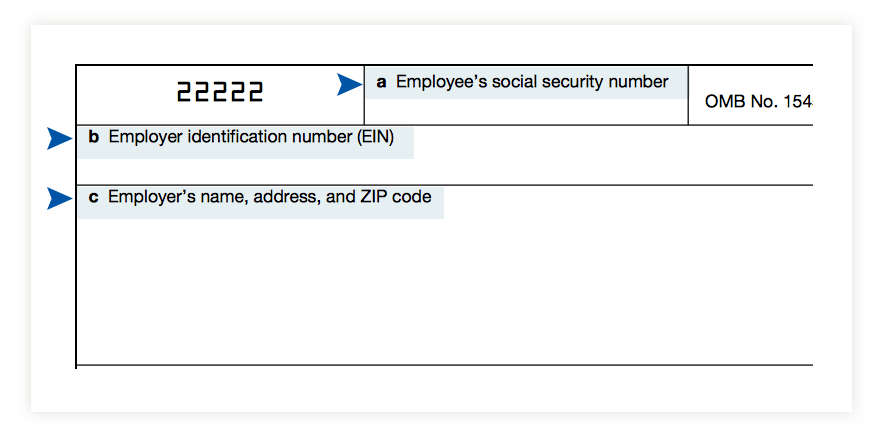

Free W2 Software Demo & W-2 Free Software Download W2 Mate is a powerful W2 / 1099 software that supports a number of forms other than 1099-MISC and W2. To read about the full capabilities of W2 Mate click here. Nov 22, 2016 - No, an actual Form W-2 cannot be printed using TurboTax. In the PDF of the tax return if you downloaded the PDF to include All forms. You can also get a Wage and Income transcript from the IRS for free which is a.

If you machine has higher security settings, you may need to save this installation package to the local machine first. (See step 1) 3. You can also download ezW2 from 4. Please feel free to if you need any help. Depending on machine settings, some user may need to restart computer after installation. Steps to download and install ezW2 software Step 1: Download ezW2 installation to your local machine first Click the Download Now button above (or the download link for the old version) and save the installation package to your local machine.

Step 2: After download completes, click Run button to start installation process. Step 3: start this installation. Our software can run on Windows 10, 8.1, 7, Vista and other Windows computers. You may see such message '.net framework version x.x is required' if.net framework is disabled or not installed on your machine. Please follow this guide to Step 4: Following the instructions on screen to continue installation.

After installation is completed, the shortcut will be created on your screen. Step 5: Run ezW2 software and print tax forms.

You can click ezW2 desktop to run ezW2 software 5.2 If you have purchased the license key, you can enter the license key. Otherwise, you can test drive the trial version.

The trial version will print Trial image on checks. You need to purchase and enter the license to remove it. 5.3 Prepare and print forms • Trouble Shooting: Related Links:• • •.

Full Site Disclaimers • H&R Block Online Deluxe or Premium, or H&R Block Software Basic, Deluxe, Premium or Premium & Business get unlimited sessions of live, personal tax advice with a tax professional. You can ask our tax advisors an unlimited number of questions at no extra cost (excludes business returns). Standard live chat hours apply (10:00 a.m. To 10:00 p.m. Mon.-Fri; 9:00 a.m.

(all times CT). • Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2018 individual income tax return (federal or state). It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

Additional terms and restrictions apply; See for complete details. • H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. • H&R Block is a registered trademark of HRB Innovations, Inc.

• Emerald Cash Rewards ™ are credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Merchants/Offers vary.

• If you find an error in the H&R Block online tax program that entitles you to a larger refund (or smaller liability), we will refund the fees you paid us to use our program to prepare that return and you may use our program to amend your return at no additional charge. To qualify, the larger refund or smaller tax liability must not be due to differences in data supplied by you, your choice not to claim a deduction or credit, positions taken on your return that are contrary to law, or changes in federal or state tax laws after January 1, 2019.

• If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, H&R Block will reimburse you up to a maximum of $10,000. Terms and conditions apply; see for details. • H&R Block is a registered trademark of HRB Innovations, Inc. TurboTax ® and Quicken ® are registered trademarks of Intuit, Inc. TaxAct ® is a registered trademark of TaxAct, Inc. Windows ® is a registered trademark of Microsoft Corporation. • Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17).